Asymmetric and symmetric meta-correlations in financial markets

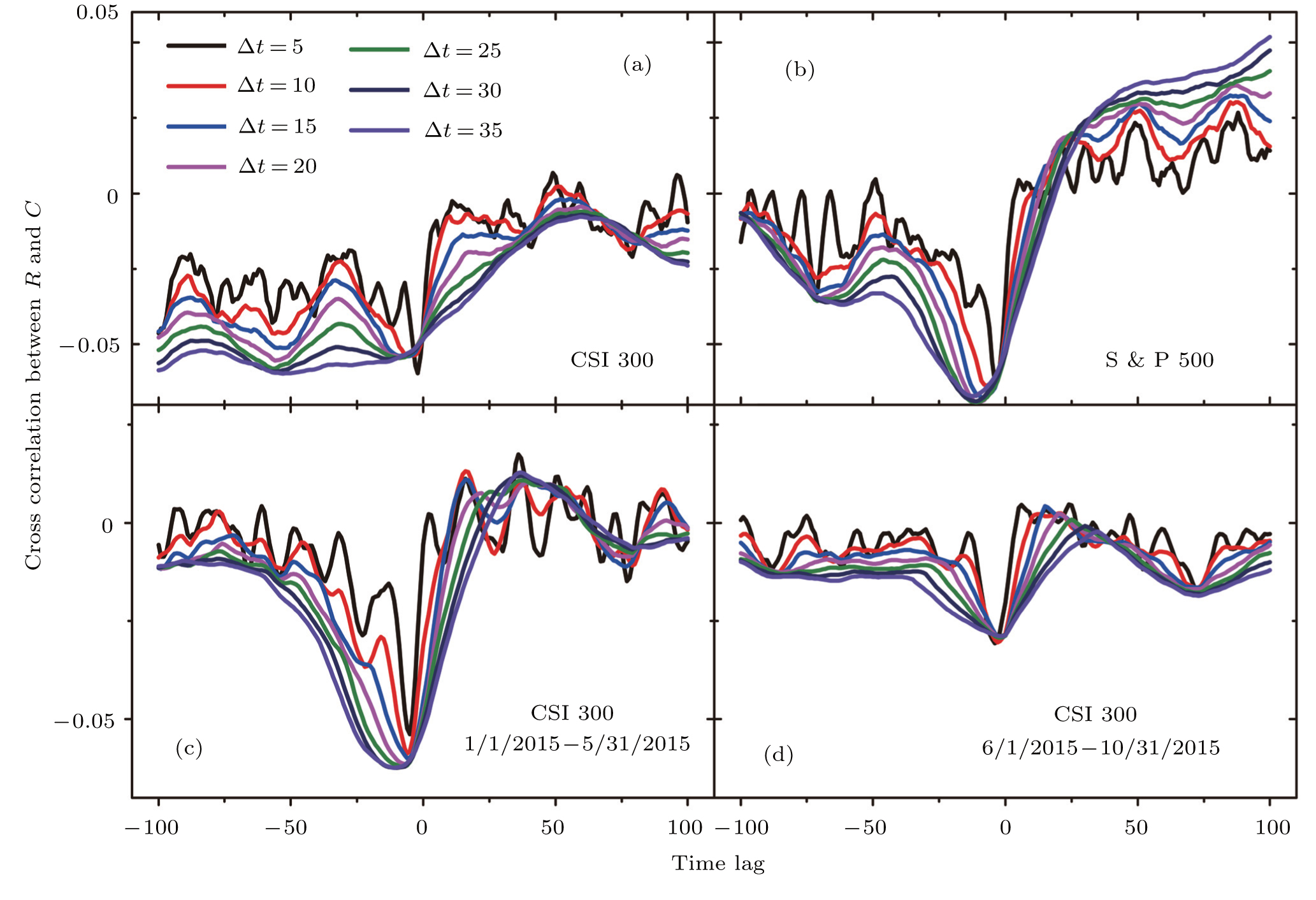

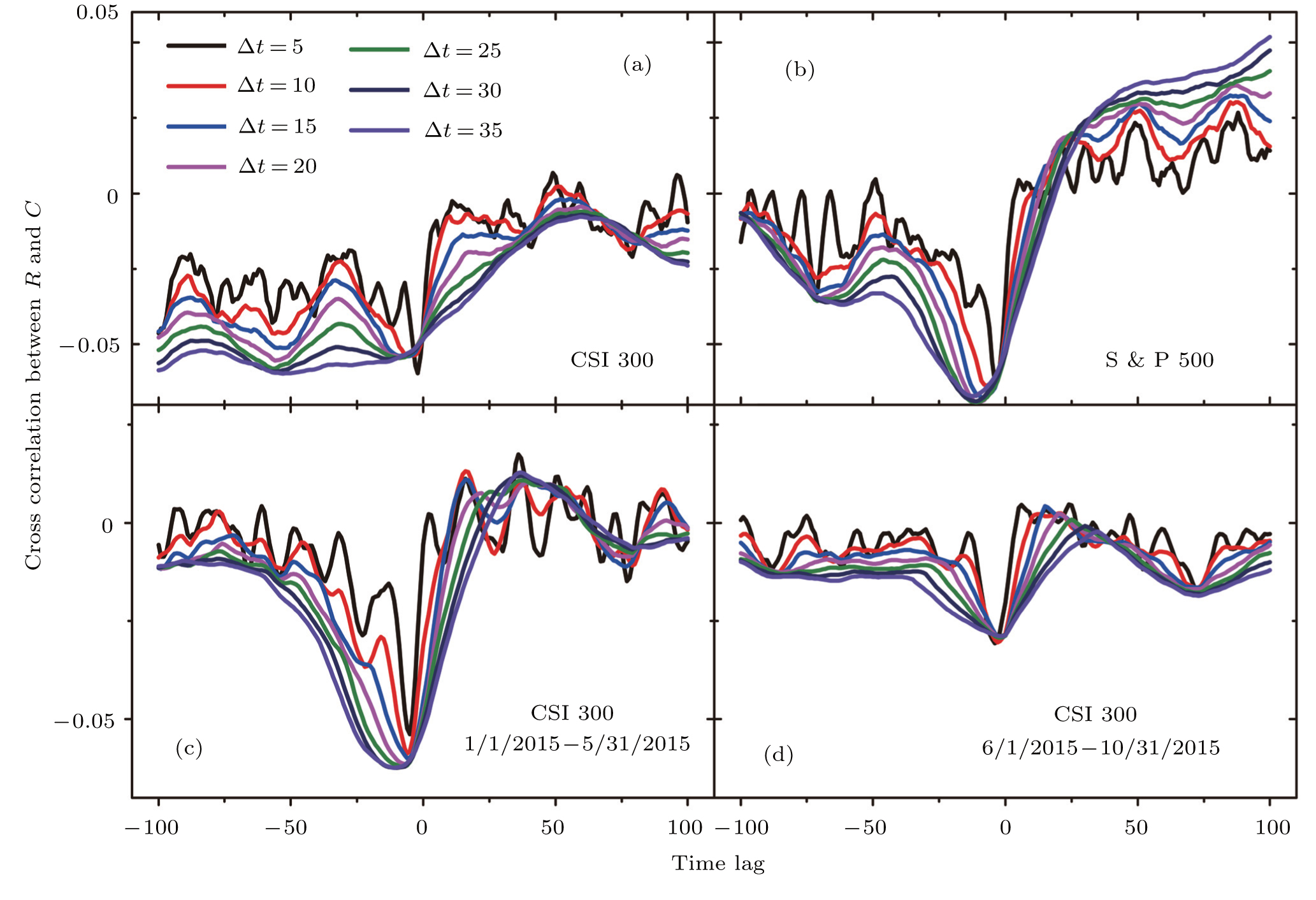

Panels (a) and (b) show the cross-correlations between the normalized index return

Asymmetric and symmetric meta-correlations in financial markets |

Panels (a) and (b) show the cross-correlations between the normalized index return |

|