Cross-correlation matrix analysis of Chinese and American bank stocks in subprime crisis

Cross-correlation matrix analysis of Chinese and American bank stocks in subprime crisis |

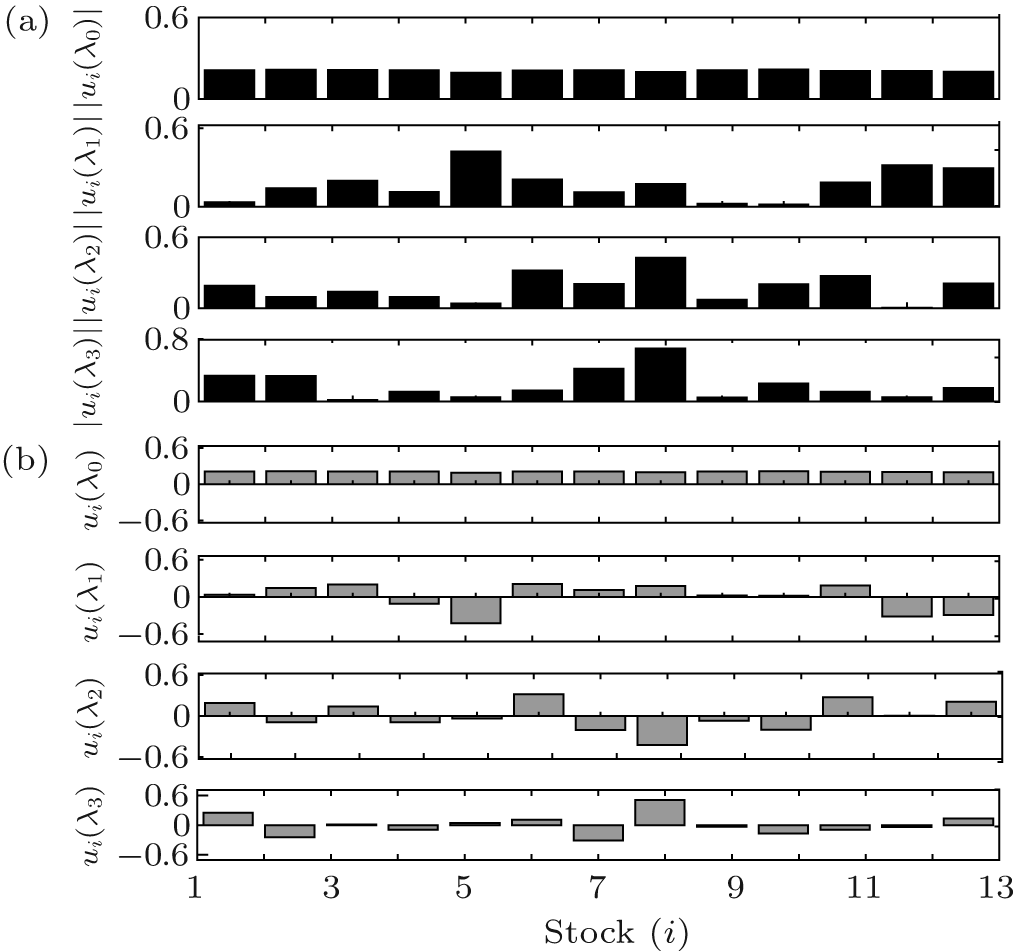

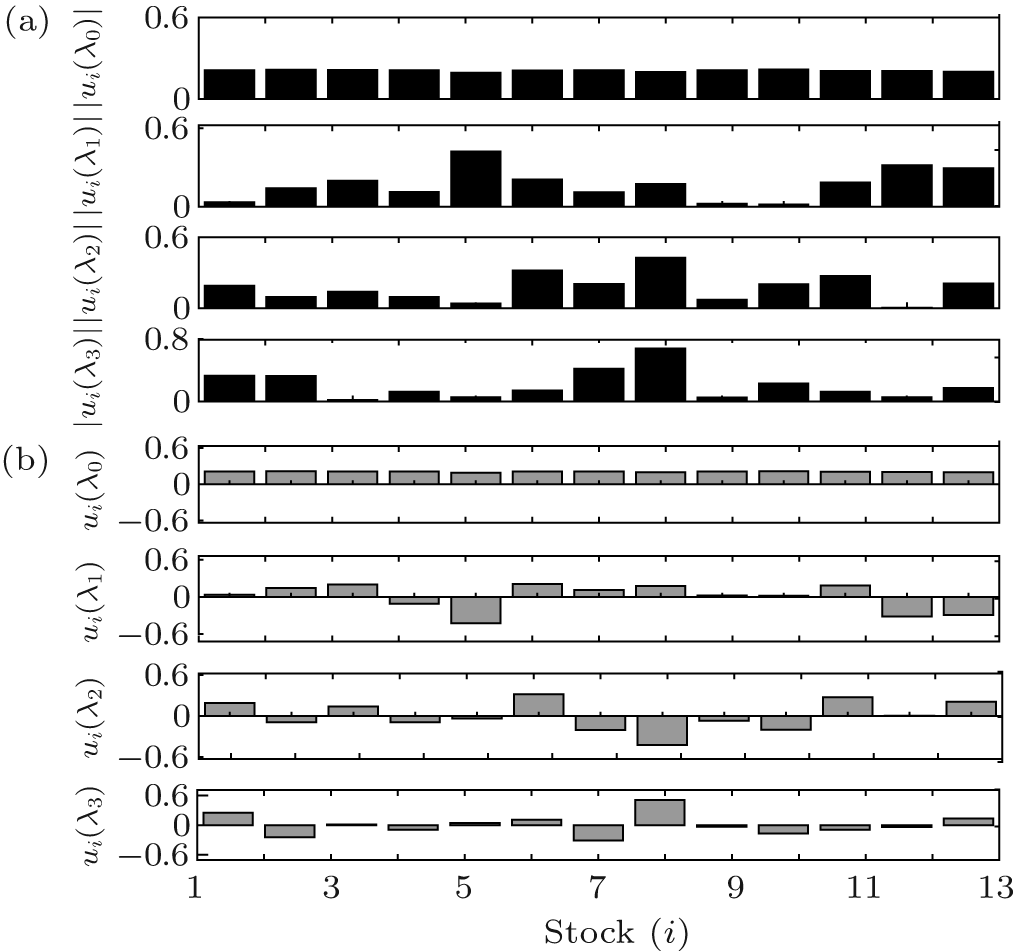

| Comparison between the absolute value ∣ u i ( λ )∣ algorithm by Ref. [ 13 ] (a) and the positive and negative u i ( λ ) algorithm in this paper (b). Components of eigenvectors corresponding to the largest four eigenvalues of cross-correlation matrix C 13×13 for stocks of Chinese banks from 2008–2010 year. Here, i is the stock number. |

|