Cross-correlation matrix analysis of Chinese and American bank stocks in subprime crisis

Cross-correlation matrix analysis of Chinese and American bank stocks in subprime crisis |

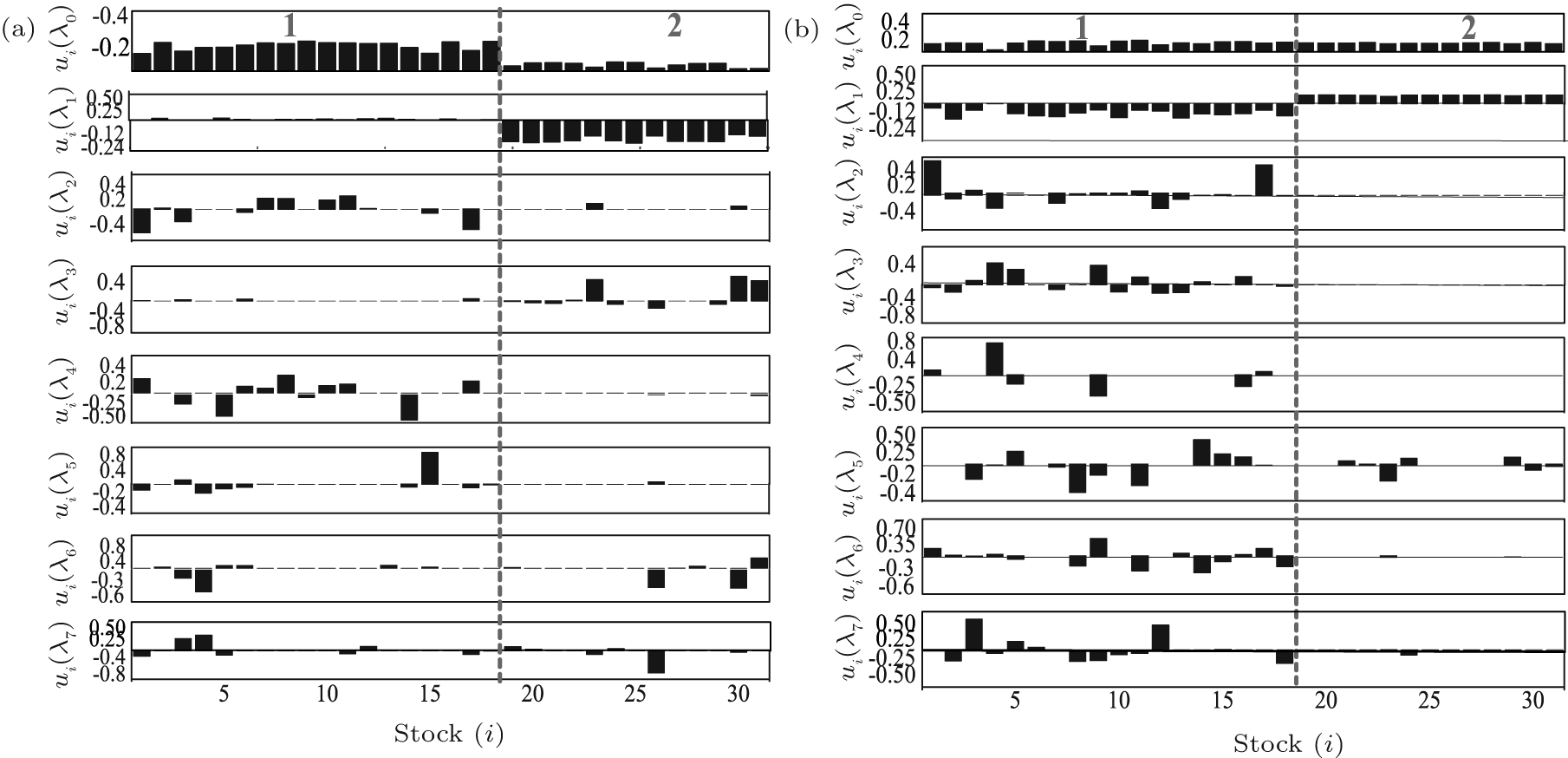

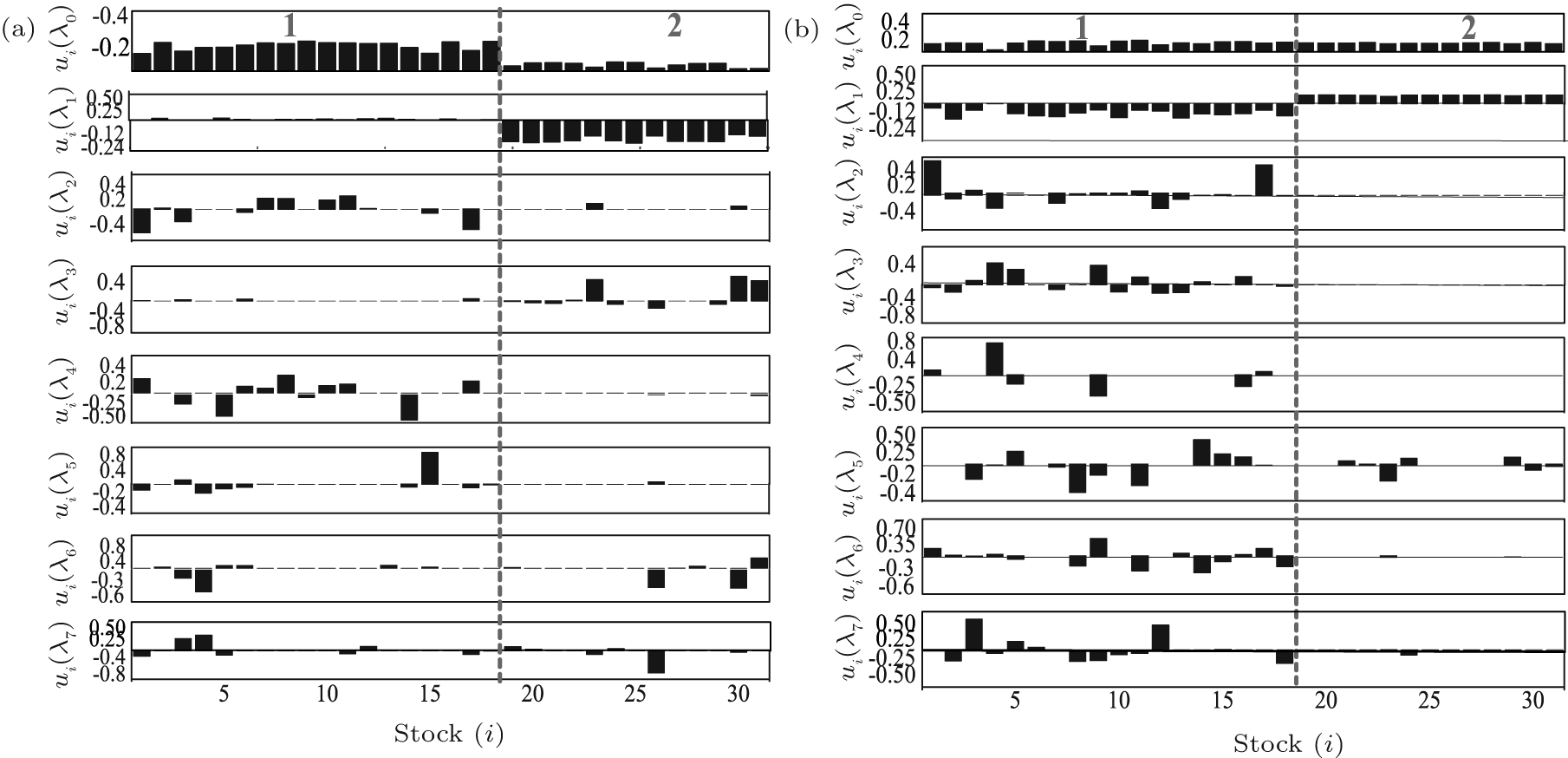

| The positive and negative components u i ( λ ) matrix C 31×31 for the eigenvectors out of threshold ∣ u i ∣≥ 0.08 corresponding to the eight largest eigenvalues of the cross-correlation matrix, where i is the stock number. Stocks have been used in accordance with their respective countries to re-sort and divide by dotted lines. (a) 2008–2010 American and Chinese bank stocks before the subprime crisis, (b) 2011–2013 American and Chinese bank stocks after the subprime crisis: number 1 means American bank stocks, and number 2 means Chinese bank stocks. |

|