Cross-correlation matrix analysis of Chinese and American bank stocks in subprime crisis

Cross-correlation matrix analysis of Chinese and American bank stocks in subprime crisis |

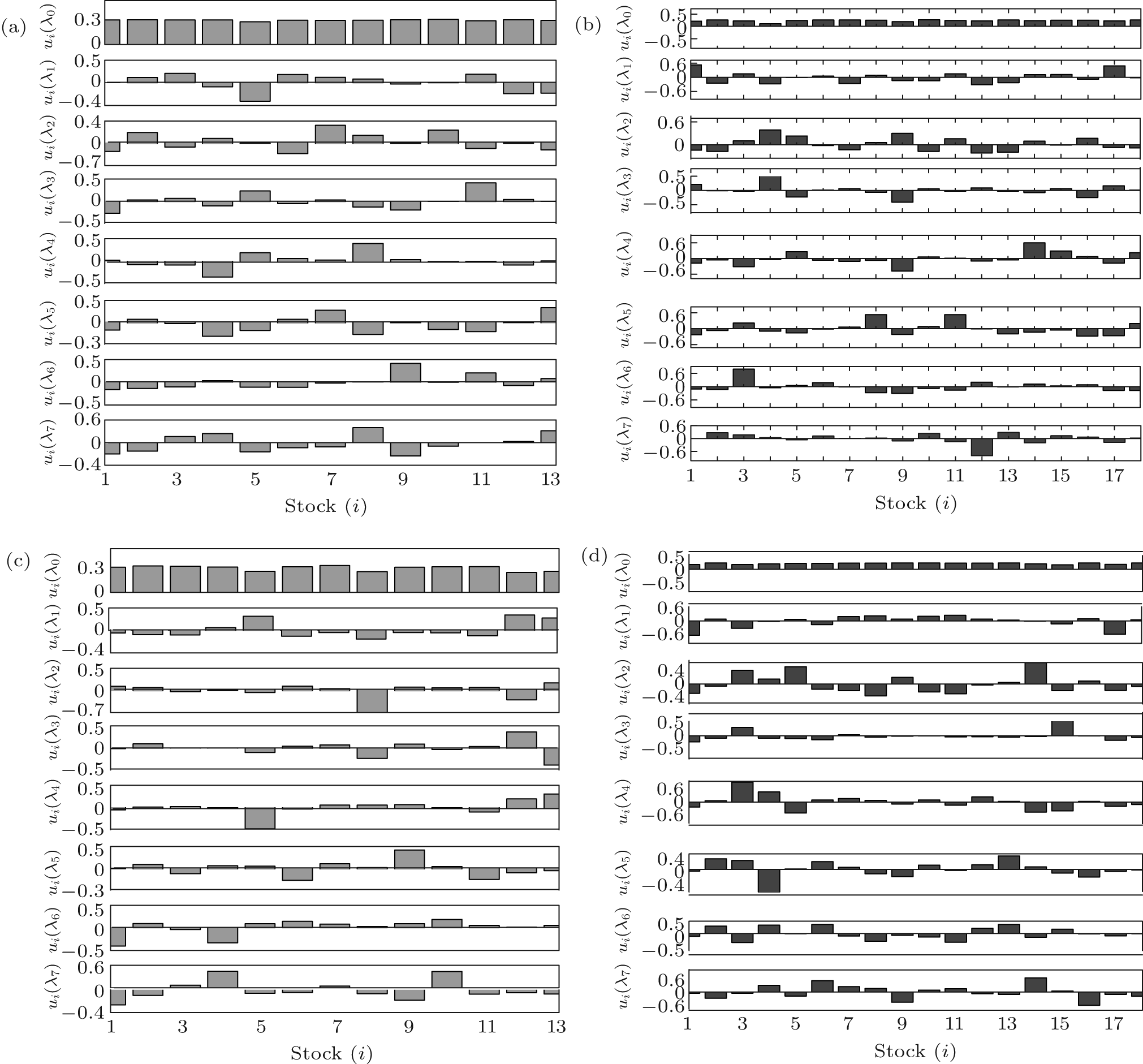

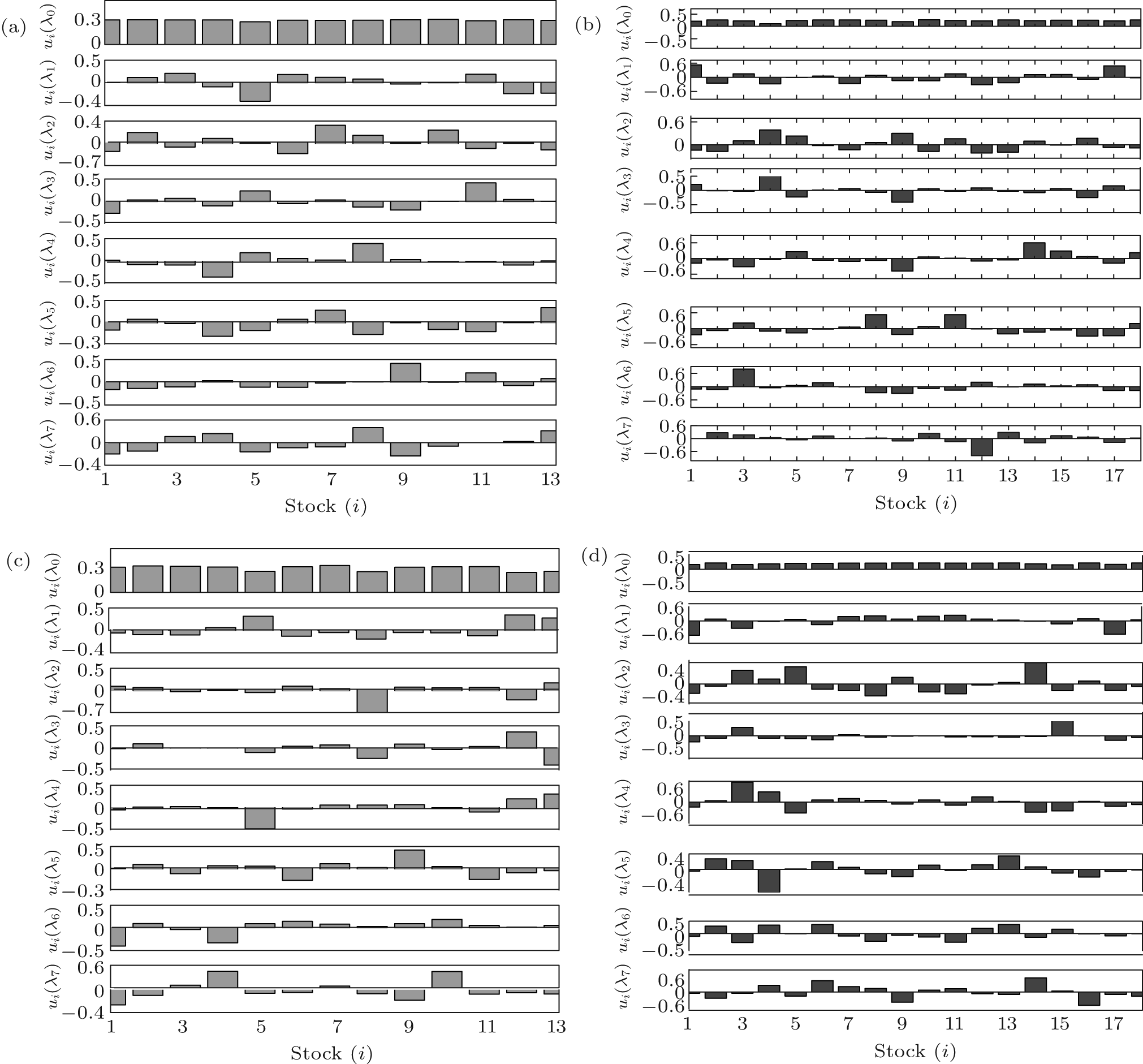

| The eigenvectors corresponding to the eight largest eigenvalues of the cross-correlation matrix, for C 13×13 in Chinese Banks and C 18×18 in American Banks. (a) 2008–2010 Chinese bank stocks before the subprime crisis, (b) 2008–2010 American bank stocks before the subprime crisis, (c) 2011–2013 Chinese bank stocks after the subprime crisis, (d) 2011–2013 American bank stocks after the subprime crisis. Here, i is the stock number. |

|